Charles F. Willis, IV

Chairman of the Board

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material | |

Willis Lease Finance Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

WILLIS LEASE FINANCE CORPORATION

NOTICE OF 20032004 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 28, 2003

26, 2004

To our Stockholders:

You are cordially invited to attend the 20032004 Annual Meeting of Stockholders of WILLIS LEASE FINANCE CORPORATION ("Willis Lease Finance" or the "Company"), which will be held at Willis Lease Finance's executive offices, 2320 Marinship Way, Suite 300, Sausalito, California at 2:00 p.m. local time on May 28, 2003,26, 2004, for the following purposes:

These matters are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on March 31, 20032004 as the record date for determining those stockholders who will be entitled to notice of and to vote at the meeting. The stock transfer books will not be closed between the record date and the date of the meeting.

A quorum comprising the holders of the majority of the outstanding shares of common stock of Willis Lease Finance on the record date must be present or represented for the transaction of business at the 20032004 Annual Meeting of Stockholders. Accordingly, it is important that your shares be represented at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE AS PROMPTLY AS POSSIBLE, to ensure that your shares will be voted at the 20032004 Annual Meeting of Stockholders. You may revoke your proxy at any time prior to the time it is voted.

The Proxy material is being delivered to you on or about April 28, 2003.May 1, 2004. Please read the proxy material carefully. Your vote is important and Willis Lease Finance appreciates your cooperation in considering and acting on the matters presented.

| By Order of the Board of Directors, | ||

| ||

Charles F. Willis, IV Chairman of the Board | ||

May 1, 2004

WILLIS LEASE FINANCE CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

| | Page | |

|---|---|---|

| SOLICITATION AND VOTING OF PROXIES | 1 | |

INFORMATION ABOUT THE BOARD OF DIRECTORS AND THE COMMITTEES OF THE BOARD | 2 | |

PROPOSAL 1 ELECTION OF CLASS | 7 | |

PROPOSAL 2 AMENDMENT | 7 | |

EXECUTIVE OFFICERS OF WILLIS LEASE FINANCE CORPORATION | 10 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 12 | |

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934 | 13 | |

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION | 13 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 16 | |

REPORT OF THE AUDIT COMMITTEE | 16 | |

INDEPENDENT PUBLIC ACCOUNTANTS | 17 | |

EXECUTIVE COMPENSATION AND RELATED INFORMATION | 18 | |

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND CHANGE-IN-CONTROL AGREEMENTS | 20 | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 22 | |

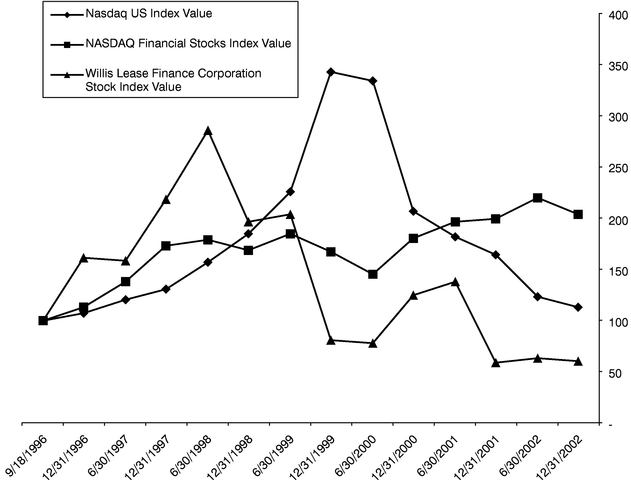

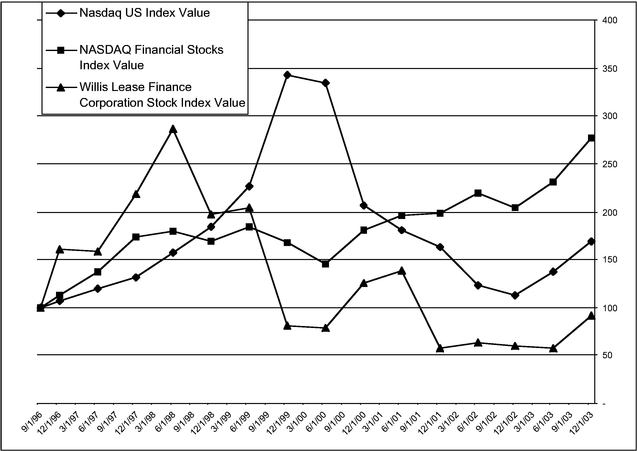

STOCK PERFORMANCE GRAPH | 23 | |

STOCKHOLDER PROPOSALS | 23 | |

OTHER MATTERS | 24 | |

INCORPORATION BY REFERENCE | 24 | |

Exhibit A: Willis Lease Finance Corporation | ||

Exhibit B: Willis Lease Finance Corporation Charter of the Audit Committee of the Board of Directors | B-1 |

i

Stockholders should read the entire proxy

statement carefully prior to returning their proxies

PROXY STATEMENT

FOR20032004 ANNUAL MEETING OF STOCKHOLDERS

OF

WILLIS LEASE FINANCE CORPORATION

To Be Held on May 28, 200326, 2004

SOLICITATION AND VOTING OF PROXIES

General

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors also(also referred to as the Board,Board) of WILLIS LEASE FINANCE CORPORATION ("Willis Lease Finance" or the "Company") of proxies to be voted at the 20032004 Annual Meeting of Stockholders, which will be held at 2:00 p.m. local time on May 28, 200326, 2004 at Willis Lease Finance's executive offices, located at 2320 Marinship Way, Suite 300, Sausalito, California 94965, or at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of 20032004 Annual Meeting of Stockholders.

This Proxy Statement is being mailed to stockholders on or about April 28, 2003.May 1, 2004. Willis Lease Finance's 20022003 Annual Report is being mailed to stockholders concurrently with this Proxy Statement. The 20022003 Annual Report is not to be regarded as proxy soliciting material or as a communication by means of which any solicitation of proxies is to be made.

Voting

The close of business on March 31, 20032004 is the record date for stockholders entitled to notice of and to vote at the 20032004 Annual Meeting of Stockholders. As of that date, Willis Lease Finance had 8,838,1408,887,160 shares of common stock, $0.01 par value, issued and outstanding. All of the shares of Willis Lease Finance's common stock outstanding on the record date are entitled to vote at the 20032004 Annual Meeting of Stockholders, and stockholders of record entitled to vote at the meeting will have one vote for each share of common stock so held with regard to each matter to be voted upon.

The required quorum for the meeting is a majority of the outstanding shares of common stock eligible to be voted on the matters to be considered at the meeting. In the election for directorsdirector (Proposal 1), the two nomineesnominee for the Class II DirectorsIII Director receiving the highest number of affirmative votes will be elected. The affirmative vote of a majority of the outstanding voting shares present or represented and entitled to vote at the 20032004 Annual Meeting of Stockholders is required for the approval of the amendment to the Company's 1996Employee Stock Option/Stock IssuancePurchase Plan (the "1996 Plan""ESPP") (Proposal 2).

Shares of Willis Lease Finance's common stock represented by proxies on the accompanying proxy card, which are properly executed and returned to Willis Lease Finance, will be voted at the 20032004 Annual Meeting of Stockholders in accordance with the stockholder's instructions contained therein. If no instructions are marked on the proxy card, the shares represented thereby will be voted (i) for the election of the Board's nomineesnominee as Class II DirectorsIII Director (Proposal 1) and (ii) for the amendment to the ESPP (Proposal 2).

1

1996 Plan (Proposal 2). If a properly signed proxy or ballot indicates that a stockholder, broker or other nominee abstains from voting or that the shares are not to be voted on a particular proposal, the shares will not be counted as having been voted on that proposal, although such shares will be counted as being in attendance at the meeting for purposes of determining the presence of a quorum. Broker non-votes (i.e. shares held by brokers or nominees as to which instructions have not been received from beneficial owners or persons entitled to vote that the broker or nominee does not have discretionary power to vote on a particular matter) are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved by a majority of the shares represented in person or by proxy and entitled to vote.

Management does not know of any matters to be presented at the 20032004 Annual Meeting of Stockholders other than those set forth in this Proxy Statement and in the Notice accompanying this Proxy Statement. If other matters should properly come before the meeting, the proxy holders will vote on such matters in accordance with their best judgment.

Revocability of Proxies

Any stockholder giving a proxy in the form accompanying this Proxy Statement has the right to revoke it at any time before it is voted at the meeting. It may be revoked by filing with the Corporate Secretary of Willis Lease Finance an instrument of revocation or by the presentation at or prior to the meeting of a duly executed proxy bearing a later date. It may also be revoked by attendance at the meeting and election to vote in person.

Solicitation

This solicitation is made by the Board of Willis Lease Finance. The entire cost of preparing, assembling and mailing the Notice of 20032004 Annual Meeting of Stockholders, this Proxy Statement and the enclosed proxy card, and of soliciting proxies, will be paid by Willis Lease Finance. Proxies will be solicited principally through the use of the mails, but, if deemed desirable, may be solicited personally or by telephone, electronic mail or special letter by officers and regular Company employees for no additional compensation. The Company has retained American Stock Transfer & Trust and ADP to aid in the solicitation at an estimated cost to the Company of approximately $5,000 plus out-of-pocket expenses.

2

INFORMATION ABOUT THE BOARD OF DIRECTORS

AND THE COMMITTEES OF THE BOARD

Board of Directors

The Bylaws of Willis Lease Finance provide that the authorized number of Directors of the Company is five (5).five. At the present time, the Board consists of five (5) Directors who are divided into three (3) classes: Class I (two Directors), Class II (two Directors) and Class III (one Director). One class is elected each year for a three-year term. Glenn L. Hickerson, Gérard Laviec and William M. LeRoy are independent directors, as defined in the Nasdaq listing standard.

The business, property and affairs of Willis Lease Finance are managed under the direction of the Board. Directors are kept informed of Willis Lease Finance's business through discussions with the President and Chief Executive Officer and other officers of Willis Lease Finance, by reviewing materials provided to them and by participating in meetings of the Board and its committees. The Board held a total of four (4)six meetings during the fiscal year ended December 31, 2002,2003, referred to as the 20022003 fiscal year. Each incumbent director attended at least 75% of the aggregate ofof: (i) the total number of meetings of the BoardBoard; and (ii) the total number of meetings held by all Committees of the Board on which he served. One director attended the 2003 annual stockholder's meeting.

Communications with the Board

Stockholders may communicate with the Board of Directors by sending a letter to Board of Directors, Willis Lease Finance Corporation, c/o Office of the Corporate Secretary, 2320 Marinship Way, Suite 300, Sausalito, California 94965. The Office of the Corporate Secretary will receive the correspondence and forward it to the Board of Directors or to any individual director or directors to whom the communication is directed, unless the communication is unduly hostile, threatening, illegal, does not reasonably relate to Willis Lease Finance or its business, or is similarly inappropriate. The Office of the Corporate Secretary has the authority to discard or disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications.

Committees of the Board

The Board of Directors has an Audit Committee and a Compensation Committee, both comprised solely of independent directors. There is no nominating committee or committee performing the functions of such a committee.

The Audit Committee oversees Willis Lease Finance's accounting function, internal controls and financial reporting process on behalf of the Board of Directors. The Audit Committee meets with Willis Lease Finance's financial management and its independent auditors to review Willis Lease Finance's financial statements and filings, the audit and matters arising therefrom, and Willis Lease Finance's financial reporting procedures including any significant judgments made in preparation of the financial statements. From January 1, 2002 through February 20, 2002, this Committee consisted of Directors William M. LeRoy (Chairman), Glenn L. Hickerson and Willard H. Smith, Jr. Effective February 20, 2002, the Board authorized a change in theThe Audit Committee composition, which currently consists of Directors William M. LeRoy (Chairman), Glenn L. Hickerson and Gérard Laviec. This Committee held six (6) meetings during the 20022003 fiscal year. On June 13, 2000, the Audit Committee adopted an Audit Committee Charter that meets the requirements of the Securities and Exchange Commission and National Association of Securities Dealers.

The Compensation Committee reviews and approves Willis Lease Finance's compensation arrangements for executive officers and administers the 1996 Plan and the Deferred Compensation Plan. From January 1, 2002 through February 20, 2002, this Committee consisted of Glenn L. Hickerson (Chairman), William M. LeRoy and Willard H. Smith, Jr. Effective as of February 20, 2002, the Board authorized a change in theThe Compensation Committee composition, which currently consists of Directors Glenn L. Hickerson (Chairman), William M. LeRoy and Gérard Laviec. This Committee held three (3) meetings during the 20022003 fiscal year.

The Board of Directors has determined that the function of a nominating committee is adequately fulfilled by the independent directors and, therefore, has not established such a committee.

Director Compensation

InEffective July 1, 2003 the 2002 fiscal year,cash compensation for the independent members of the Board were eachwas increased. Under the new schedule directors are paid an annual feeretainer of $12,500.$20,000 plus $1,000 for each Board meeting attended in person and $500 for each Board meeting attended by conference telephone. Independent directors serving on the Committees are paid $500 for each Committee meeting attended either in person or by telephone. Finally, the Chairman of the Audit Committee is paid $7,500; while the chairman of the Compensation Committee receives $5,000. Each independent member of the Board was also reimbursed for all reasonable out-of-pocket costsexpenses incurred to attend Board or Committee meetings. In addition, each independent member of the Board receives $1,000 for each Board meeting and $500 for each Committee meeting which he attends in person, and $500 and $250, respectively, for each Board and Committee meeting attended by telephone. Pursuant to the "Automatic Option Grant Program" under the Willis Lease Finance Corporation 1996 Stock Option/Stock Issuance Plan (the "1996 Plan", each individual

3

who first becomes a non-employee Board member is eligible to receive an option grant for 5,000 shares of common stock. In addition, on the date of each annual stockholders meeting, each individual who is to continue to serve as an independent Board member, whether or not such individual is standing for re-election at that particular annual meeting, will be granted an option to purchase a specified number of shares of common stock, provided such individual has served as an independent Board member for at least six months. The number of shares of common stock subject to each annual automatic option

grant shall not be more than 10,000 shares per year, and the number of shares will be determined by dividing $20,000 by the Black-Scholes formula value of the option. Each grant under the Automatic Option Grant Program will have an exercise price per share equal to the fair market value per share of Willis Lease Finance's common stock on the grant date and will have a maximum term of 10 years, measured from the grant date, subject to earlier termination should the optionee cease to serve as a member of the Board.

Each 5,000-share initial option grant vests in a series of four successive equal annual installments over the optionee's period of continued service as a Board member measured from the option grant date. Each $20,000 value annual option grant vests in one installment uponon the optionee's completion of one year of Board service measured from the grant date.

Independent Directors are also eligible to participate in the Director Fee Option Grant Program in effect under the 1996 Plan, pursuant to which they may elect to apply a portion or all of their annual compensation towards the acquisition of special below-market option grants. Options granted to independent Directors under the Director Fee Option Grant Program have a maximum term of 10 years, measured from the grant date, subject to earlier termination should the optionee cease to serve as a member of the Board.

Pursuant to the Stockholder's Agreement by and among Willis Lease Finance, Charles F. Willis, IV, CFW Partners, L.P., Austin Chandler Willis 1995 Irrevocable Trust, and FlightTechnics, LLC dated as of November 7, 2000, Mr. Hans Jörg Hunziker and Mr. Hunziker's successor, Mr. William Coon (or any successor to Mr. HunzikerCoon nominated by FlightTechnics, LLC to the Board) is not considered an independent director of Willis Lease Finance. Accordingly, Mr. Hunziker did not and Mr. Coon does not participate in the above-described compensation arrangements for independent members of the Board.

On March 28, 2002,31, 2003, Directors LeRoy, Hickerson and Laviec, in connection with their elections to apply $5,125$5,625, $5,625 and $969$1,281 respectively of their compensation for the first quarter of the 20022003 fiscal year to the acquisition of a special grant under the Director Fee Option Grant Program, were granted options for 1,6421,488, 1,488 and 310338 shares of common stock under that program, respectively. These options have an exercise price of $1.56$1.89 per share, one-third of the fair market value per share of the common stock on the grant date. The spread on the option shares at the time of grant (the fair market value of the option shares less the aggregate exercise price) was equal to $5,125$5,625, $5,625 and $969$1,281 of their cash retainer fees which Directors LeRoy and Laviec, respectively, elected to apply to their grants. These options became fully exercisable on March 28, 2002.31, 2003.

On June 28, 2002,30, 2003, Directors LeRoy, Hickerson and Laviec, in connection with their elections to apply $5,125$5,625, $5,625 and $906,$1,406, respectively of their compensation for the second quarter of the 20022003 fiscal year to the acquisition of a special grant under the Director Fee Option Grant Program, were granted options for 1,5911,820, 1,820 and 281455 shares of common stock under that program, respectively. These options have an exercise price of $1.61$1.54 per share, one-third of the fair market value per share of the common stock on the grant date. The spread on the option shares at the time of grant (the fair market value of the option shares less the aggregate exercise price) was equal to $5,125$5,625, $5,625 and $906$1,406 of their cash retainer fees which Directors LeRoy, Hickerson and Laviec, respectively, elected to apply to their grants. These options became fully exercisable on June 28, 2002.30, 2003.

On September 30, 2002,2003, Directors LeRoy, Hickerson and Laviec, in connection with their election to apply $5,375$11,875, $11,250 and $1,219,$2,250, respectively of their compensation for the third quarter of the 20022003 fiscal year to

4

the acquisition of a special grant under the Director Fee Option Grant Program, were granted options of 2,0673,244, 3,073 and 468614 shares of common stock under that program, respectively. These options have an exercise price of $1.30$1.83 per share, one-third of the fair market value per share of the common stock on the grant date. The spread on the option shares at the time of grant (the fair market value of the option shares less the aggregate exercise price) was equal to $5,375$11,875, $11,250 and $1,219,

$2,250, respectively, of the quarterly cash retainer fees which Directors LeRoy, Hickerson and Laviec, respectively, elected to apply to their grants. These options became fully exercisable on September 30, 2002.2003.

On December 31, 2002,2003, Directors LeRoy, Hickerson and Laviec, in connection with their election to apply $5,125$8,375, $7,750 and $1,031$1,375, respectively of their compensation for the fourth quarter of the 20022003 fiscal year to the acquisition of a special grant under the Director Fee Option Grant Program, were granted options for 1,5201,709, 1,581 and 306280 shares of common stock under that program, respectively. These options have an exercise price of $1.68$2.45 per share, one-third of the fair market value per share of the common stock on the grant date. The spread on the option shares at the time of grant (the fair market value of the option shares less the aggregate exercise price) was equal to $5,125$8,375, $7,750 and $1,031,$1,375, respectively, of their quarterly cash retainer fees which Directors LeRoy, Hickerson and Laviec, respectively, elected to apply to their grants. These options became fully exercisable on December 31, 2002.2003.

Biographical Information

| | Director Since | Age* | Director Since | Age* | ||||

|---|---|---|---|---|---|---|---|---|

| Class II Directors Whose Terms Expire at the 2003 Annual Meeting: | ||||||||

| Glenn L. Hickerson | 2001 | 65 | ||||||

| Gérard Laviec | 2002 | 63 | ||||||

Class III Director Whose Term Expires at the 2004 Annual Meeting: | ||||||||

| Charles F. Willis, IV | 1985 | 54 | 1985 | 55 | ||||

Class I Directors Whose Terms Expire at the 2005 Annual Meeting: | ||||||||

| William M. LeRoy | 1996 | 60 | 1996 | 61 | ||||

| Hans Jörg Hunziker | 2000 | 53 | ||||||

| W. William Coon Jr. | 2003 | 64 | ||||||

Class II Directors Whose Terms Expire at the 2006 Annual Meeting: | ||||||||

| Glenn L. Hickerson | 2001 | 66 | ||||||

| Gérard Laviec | 2002 | 64 | ||||||

*

Principal Occupations of Nominees and Continuing Directors

Charles F. Willis, IV is the founder of Willis Lease Finance, has served as Chief Executive Officer, President and a Director since its incorporation in 1985, and has served as Chairman of the Board of Directors since 1996. Mr. Willis has 3435 years of experience in the aviation industry. From 1975 to 1985, Mr. Willis served as president of Willis Lease Finance's predecessor, Charles F. Willis Company, which purchased, financed and/or sold a variety of large commercial transport aircraft and provided consulting services to the aviation industry. During 1974, Mr. Willis operated a small business not involved in the aviation industry. From 1972 through 1973, Mr. Willis was Assistant Vice President of Sales at Seaboard World Airlines, a freight carrier. From 1965 through 1972, he held various positions at Alaska Airlines, including positions in the departments of flight operations, sales and marketing.

Glenn L. Hickerson joined the Board of Directors of Willis Lease Finance in July 2001. Since November 1997, Mr. Hickerson has been President of Hickerson Associates, a California corporation providing marketing and management services to GATX, IBM, Bank One, and other clients. Mr. Hickerson joined GATX Air Group, specializing in commercial aircraft leasing, finance and portfolio management, as an Executive Vice President in 1990 and was made President of the Air Group in 1995. Following his retirement from active service with GATX Air Group, he was named

5

Chairman of the GATX Air Advisory Board in November 1997, a position he still holds. Prior to joining GATX Air Group he was President of GPA Asia Pacific. From 1983 to 1989, Mr. Hickerson was Vice President Commercial Marketing and Sales, Douglas Aircraft Company. At Lockheed California Company from 1976 to 1983, he was Vice President Marketing and Sales International and earlier

Director Marketing and Sales—The Americas. From 1972 to 1976, Mr. Hickerson was a Vice President at Marriott Corporation responsible for Marriott's travel and cruise ship interests. From 1967 to 1972, Mr. Hickerson was at Universal Airlines as President from 1970 to 1972 and earlier as Vice President and Treasurer. From 1962 to 1967 he was at Douglas Aircraft Company starting as a Credit Analyst later becoming Secretary Treasurer of the Douglas Finance Corporation. Mr. Hickerson is also President and a Director of Quality Aerospace, a GATX subsidiary involved in aircraft parts manufacture. Mr. Hickerson received a B.S. from Claremont McKenna College and an M.B.A. from New York University's Graduate School of Business (now Stern School).

Hans Jörg Hunziker has served as a Director of Willis Lease Finance since November 2000. Mr. Hunziker started his own consultancy company, Hunziker Lease and Finance in August, 2002 which is presently engaged by the Company. Previously he was President and Chief Executive Officer of Flightlease AG Ltd., active in aircraft leasing and a subsidiary of SAirGroup, a public company with headquarters in Zurich, Switzerland. He held this position from 1998 to June 30, 2002. Until December 20, 2002, he was Chairman of the Board of SRTechnics Switzerland. He was also Chairman of the Board of SRTechnics Group until January 27, 2003. From 1998 to 2001, he was co-CEO of GATX Flightlease Management GmbH, an asset management and commercial aircraft leasing company. From 1996 to 1998 he was the Chief Financial Officer of SAirServices Ltd., a group of companies including aircraft maintenance and overhaul, ground handling services, information technology and real estate, and Managing Director of SAirServices Invest Ltd. From 1991 to 1996, he was Chief Financial Officer of Swissair Associated Companies Ltd., a group of 150 companies, primarily in the hotel, catering (Gate Gourmet) and trading business. Mr. Hunziker holds a Masters degree in economics and business administration from the University of Zurich. He also holds the equivalent of a doctoral degree from the University of Zurich, after successful completion of his thesis on Strategic Planning in the Airline Industry. In addition to serving as a director of Willis Lease Finance, he is a Member of the Board of Directors of Swissport Brazil Ltd., and Gotland Shipping AG.

Gérard Laviec joined the Board of Directors of Willis Lease Finance in February 2002. In 2001, Mr. Laviec retired from his position as President and Chief Executive Officer of CFM International, a partnership between General Electric Company and SNECMA and a supplier of engines for commercial jets. Mr. Laviec joined CFM International in 1976 in its incipient phase. From 1983 to 1995, he served as general manager in product support engineering, business operations, sales and marketing, and was named President and Chief Executive Officer of CFM International in 1995. Mr. Laviec has also served as the Chairman of the Board of Shannon Engine Support in Ireland, a wholly-owned CFM International subsidiary since 1995. He resigned from his position at SES in February 2002. Mr. Laviec is a graduate of INSA Lyon, France with a degree in Mechanical Engineering. He served in the French Air Force as a Flight Officer in Search and Rescue teams prior to joining SNECMA, and is a Knight for the French National Order of Merit.

William M. LeRoy has served as a Director of Willis Lease Finance since 1996. In 1993, Mr. LeRoy established the LeRoy Accountancy Corporation, an audit firm specializing in the audits of employee benefit plans and in July, 1998 merged this firm into BDO Seidman, LLP where Mr. LeRoy is now a partner. From 1965 to 1993, Mr. LeRoy served in various positions at Ernst & Young LLP, an independent accounting firm, in the Chicago, San Jose and San Francisco offices, including an assignment as audit partner responsible for the financial institution and leasing company practice in northern California. Mr. LeRoy received an M.B.A. from Golden Gate University and a B.S. in Accounting from Northern Illinois University.

6 W. William Coon, Jr. currently serves as President, CEO and Director of T Group America, as well as Director of several of its subsidiaries. Previously, he spent 34 years at GE Aircraft Engines (GEAE), a division of General Electric Company (NYSE:GE), where he served in numerous management positions. Prior to retiring from GEAE in 2000, Mr. Coon was General Manager for Small Commercial Aircraft Services. From 1984 to 1998 he served as Director of Product Support, where he was responsible for supplying global services to the company's regional airline customers. Mr. Coon holds a Bachelor of Science degree in Aeronautical Engineering from the University of Michigan and a Masters in Business Administration from Xavier University.

PROPOSAL 1

ELECTION OF CLASS II DIRECTORSIII DIRECTOR

The Board is divided into three (3) classes, each class having a three-year termsterm that expireexpires in successive years. At the 20032004 Annual Meeting of Stockholders, two DirectorsONE Director will be elected in Class II, eachIII, to serve a three-year term expiring at the 20062007 Annual Meeting of Stockholders or until succeeded by another qualified director who has been duly elected.

The nomineesnominee for Director in Class II are GLENN L. HICKERSON and GÉRARD LAVIEC.III is Charles F. Willis, IV.

The proxy holders intend to vote all proxies received by them for the foregoing nominees,nominee, unless instructions to the contrary are marked on the proxy. In the event that any nominee is unable or declines to serve as a Director at the time of the 20032004 Annual Meeting of Stockholders, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or will decline to serve as a director.

WILLIS LEASE FINANCE'S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF THE TWO NOMINEESNOMINEE AS CLASS II DIRECTORS.III DIRECTOR.

PROPOSAL 2

AMENDMENT TOAND RESTATEMENT OF THE 1996EMPLOYEE STOCK OPTION/STOCK ISSUANCEPURCHASE PLAN

The Company's stockholders are being asked to approve an amendment and restatement to the 1996 PlanESPP that will increase the maximum number of shares of common stock authorized for issuance over the term of the 1996 PlanESPP from 2,525,00075,000 to 3,025,000.175,000.

The ESPP is intended to provide employees of the Company with additional incentives by permitting them to acquire a proprietary interest in the Company through the purchase of the Company's common stock. The ESPP was initially adopted by the Company's Board of Directors on June 20, 1996 and subsequently approved by the Company's shareholders. It was amended and restated as of August 1, 1998.

Of the 75,000 shares currently authorized under the ESPP 69,331 shares have been issued. If approved, the proposed authorized share increase will assure that a sufficient reserve of common stock is available under the 1996 PlanESPP to attract and retain the services of key individuals essential to the Company's long-term growth and success.

The amendment and restatement to the 1996 PlanESPP was adopted by the Board as of March 1, 2003.April 15, 2004. The following is a summary of the principal features of the 1996 Plan,ESPP, as most recently amended. However, the summary does not purport to be a complete description of all the provisions of the 1996 Plan.ESPP. A copy of the actual plan document is attached to this Proxy Statement as Exhibit A.

Equity Incentive ProgramsAdministration

The 1996 Plan contains five (5) separate equity incentive programs: (i) a Discretionary Option Grant Program, (ii) a Salary Investment Option Grant Program, (iii) a Stock Issuance Program, (iv) an Automatic Option Grant Program, and (v) a Director Fee Option Grant Program. The principal featuresAdministration of these programs are described below. The 1996 Plan (other than the Automatic Option Grant Program)ESPP is administeredoverseen by the Compensation Committee of the Board.Board of Directors. The Compensation Committee acting in such administrative capacity (the "Plan Administrator")committee has complete discretion (subjectfull power to interpret the provisions of the 1996 Plan) to authorize option grantsESPP and, direct stock issuances under the 1996 Plan. Pursuant to provisions in the 1996 Plan, the Board may appoint a secondary committee of one or more Board members, including employee directors, to authorize option grants and direct stock issuances to eligible persons other than executive officers and Board members subject to the short-swing liability provisionsexpress terms of the federal securities laws.ESPP, to establish the terms of offerings under the ESPP. The Compensation Committee shall havedecisions of the exclusive authority to determine which officerscommittee are final and Directorsbinding on all participants.

Eligibility

All Employees of the Company that are subject to(including officers and directors), who work more than twenty hours per week and more than five months in any calendar year (unless otherwise required by local law), and who commenced employment with the short-swing profit liabilities of Section 16Company on or before the first day of the Securities and Exchange Act of 1934 and other highly compensated individualsapplicable Offering Period (as defined below), will be eligible to participate in the Salary Investment Option Grant Program for one or more calendar years, but no administrative discretion will be exercised by the Compensation Committee with respect to the grants made under the Automatic Option Grant, Salary Investment Option GrantESPP. However, and Director Fee Option Grant Programs. All grants under the Automaticemployee

7

Option Grant Program, Salary Investment Option Grant and Director Fee Option Grant Programs will be made in strict compliance with the express provisions of each program.

Share Reserve

A total of 2,525,000 shares of common stock has been reserved for issuance over the term of the 1996 Plan. In no event may any one participant in the 1996 Plan be granted stock options and direct stock issuances for more than 500,000 shares in the aggregate per calendar year under the 1996 Plan. Stockholder approval of this Proposal 2 shall reserve 500,000 additional shares of common stock for issuance over the term of the 1996 Plan, for a total of 3,025,000 shares.

In the event any change is made to the outstanding shares of common stock by reason of any recapitalization, stock dividend, stock split, combination of shares, exchange of shares or other change in corporate structure effected without the Company's receipt of consideration, appropriate adjustments will be made to (i) the maximum number and class of securities issuable under the 1996 Plan, (ii) the maximum number and class of securities for which any one participant may be granted stock options, separately exercisable stock appreciation rights, and direct stock issuances under the 1996 Plan per calendar year, (iii) the number and class of securities for which option grants will subsequently be made under the Automatic Option Grant Program to each newly-elected or continuing non-employee Board member, and (iv) the number and class of securities and the exercise price per share in effect under each outstanding option.

Should an option expire or terminate for any reason prior to exercise in full or be canceled in accordance with the provisions of the 1996 Plan, the shares subject to the portion of the option not so exercised or canceled will be available for subsequent issuance under the 1996 Plan. Unvested shares issued under the 1996 Plan and subsequently repurchased by the Company at the original option exercise or direct issue price paid per share will also be added back to the share reserve and will accordingly be available for subsequent issuance under the 1996 Plan. Shares subject to any option surrendered in accordance with the stock appreciation right provisions of the 1996 Plan will not be available for subsequent issuance.

Eligibility

Employeeseligible to participate if, as a result of participating, that employee would hold five percent or more of the total combined voting power or value of all classes of stock of the Company or of any parent or subsidiary, non-employee memberssubsidiary. Further, no employee's right to purchase common stock under the ESPP may accrue at a rate which exceeds $25,000 per year of the Boardfair market value of stock, or the board of directors of any parent or subsidiary corporation, and consultants and other independent advisors in the service$6,250 for each Offering Period of the Company or its parent or subsidiary corporations are eligible to participate in the Discretionary Option Grant and Stock Issuance Programs. Onlyfair market value of stock. Approximately 42 employees who are officers and Directors of the Company that are subject to the short-swing profit liabilities of Section 16 of the Securities and Exchange Act of 1934 or other highly compensated individuals willcurrently would be eligible to participate in the Salary Investment Option Grant Program. Non-employee membersESPP.

Offerings Under the ESPP

Eligible employees of the Board are also eligibleCompany may elect to participate in the Automatic Option GrantESPP by giving notice to the Company and Director Fee Option Grant Programs.

On March 31, 2003,instructing the Company to withhold a specified percentage of the employee's salary during successive month periods. Generally, the periods run for up to twenty four (4) executive officers, three (3) non-employee Board membersmonths and thirty-eight (38) other employees wereeach period is referred to as an "Offering Period." Each Offering Period is broken down into four Purchase Intervals of six months running from August 1 to February 1, and February 1 to July 1. An eligible employee may authorize a salary deduction of any whole percentage, up to participate in the Discretionary Option Grant and Stock Issuance Programs, and the three (3) non-employee Board members were also eligibleten percent, of his base, straight-time, gross earnings. An employee's salary deductions may be reduced to participate in the Automatic Option Grant Program and the Director Fee Option Grant Program.

Valuation

The fair market value per share of common stock on any relevant date under the 1996 Plan is the closing selling price per share on that date on the Nasdaq National Market. On March 31, 2003, the closing selling price per share was $5.67.

8

Discretionary Option Grant Program

Options granted under the Discretionary Option Grant Program will have an exercise price per share not less than the fair market value per share of common stock on the option grant date. No granted option will have a term in excess of ten (10) years. The options generally become exercisable in a series of installments over the optionee's period of service with the Company.

Upon cessation of service, the optionee has a limited period of time in which to exercisezero, without his or her outstanding options for any shares in which the option is exercisable at the time of optionee's termination of service. The Plan Administrator has complete discretion to extend the period following the optionee's cessation of service during which his or her outstanding options may be exercised and/or to accelerate the exercisability or vesting of such options in whole or in part. Such discretion may be exercisedconsent, at any time while the options remain outstanding, whether before or after the optionee's actual cessation of service.

The Plan Administrator is authorizedduring an Offering Period, to issue two types of stock appreciation rights in connection with option grants made under the Discretionary Option Grant Program: tandem stock appreciation rights and limited stock appreciation rights.

Tandem stock appreciation rights provide the holderscomply with the right to surrender their options for an appreciation distribution fromlimitations contained in the Company equal in amount to the excess of (a) the fair market valueESPP or under Section 423 of the vested sharesInternal Revenue Code of common stock subject to1986, as amended (the "Code").

Purchase Price and Shares Purchased

On the surrendered option over (b) the aggregate exercise price payable for those shares. Such appreciation distribution may, at the discretion of the Plan Administrator, be made in cash or in shares of common stock.

Limited stock appreciation rights may be provided to one or more non-employee Board members or officers of the Company as part of their option grants. Any option with such a limited stock appreciation right may be surrendered to the Company upon the successful completionlast business day of a hostile tender offer for more than fifty percent (50%) ofPurchase Interval, the Company's outstanding voting stock. In return for the surrendered option, the optioneewithheld salary will be entitledused to a cash distribution from the Company in an amount per surrendered option share equal to the excess of (a) the highest price paid per share of common stock in connection with the tender offer over (b) the exercise price payable for such share.

The shares of common stock acquired upon the exercise of one or more options may be unvested and subject to repurchase by the Company, at the original exercise price paid per share, if the optionee ceases service with the Company prior to vesting in those shares. The Plan Administrator has complete discretion to establish the vesting schedule to be in effect for any such unvested shares and, in certain circumstances, may cancel the Company's outstanding repurchase rights with respect to those shares and thereby accelerate the vesting of those shares.

The Plan Administrator also has the authority to effect the cancellation of outstanding options under the Discretionary Option Grant Program and to issue replacement options with an exercise price based on the fair market price ofpurchase common stock at the time of the new grant.

Salary Investment Option Grant Program

In the event the Plan Administrator elects to activate the Salary Investment Option Grant Program for one or more calendar years, each executive officer and other highly compensated employee of the Company selected for participation may elect, prior to the start of the calendar year, to reduce his or her base salary for that calendar year by a specified dollar amount not less than $10,000 nor more than $50,000. If such election is approved by the Plan Administrator, the individual will automatically be granted, on the first trading day in January of the calendar year for which that salary reduction is to be in effect (or the first trading day of the month following the adoption and implementation of this program if it is implemented within calendar year 2003), a non-statutory option to purchase that number of shares of common stock determined by dividing the salary reduction amount by two-thirds

9

of the fair market value per share of common stock on the grant date. The option will be exercisable at a price per share equal to one-third85% of the fair market value of the option sharescommon stock on either the grant date. As a result,first day or the total spread onlast day of the option shares at the time of grantOffering Period, whichever price is less (the "Purchase Price"). For this purpose, fair market value ofis the option sharesclosing sales price reported on the grant date less the aggregate exercise price payable for those shares) will be equal to the amount of salary invested in that option. The option will vest and become exercisable in a series of twelve (12) equal monthly installments over the calendar year for which the salary reduction is to be in effect and will be subject to full and immediate vesting upon certain changesNASDAQ or, in the ownership or controlabsence of reported sales on the Company.

The shares subject to each option underrelevant date, the Salary Investment Option Program willclosing sales price on the immediately vest upon (i) an acquisition ofpreceding date on which sales were reported. If, on the Company by merger or asset sale or (ii) the successful completionlast day of a tender offer for more than 50% ofPurchase Interval, the Company's outstanding voting stock or a change in the majority of the Board effected through one or more contested elections for Board membership.

Limited stock appreciation rights will automatically be included as part of each grant made under the Salary Investment Option Grant Program. Options with such a limited stock appreciation right may be surrendered to the Company upon the successful completion of a hostile tender offer for more than 50% of the Company's outstanding voting stock. In return for the surrendered option, the optionee will be entitled to a cash distribution from the Company in an amount per surrendered option share equal to the excess of (i) the highest price per share of common stock paid in connection with the tender offer over (ii) the exercise price payable for such share.

Automatic Option Grant Program

Under the Automatic Option Grant Program, each individual who was serving as a non-employee Board member on September 18, 1996 was granted at that time a non-statutory option to purchase 5,000 shares of common stock, provided such individual had not previously been in the Company's employ and had not otherwise received a stock option grant from the Company. Each individual who first becomes a non-employee Board member after September 18, 1996, whether through election by the stockholders or appointment by the Board, will automatically be granted, at the time of such initial election or appointment, a non-statutory option to purchase 5,000 shares of common stock, provided such individual has not previously been in the employ of the Company or any parent or subsidiary corporation. In addition, on the date of each Annual Meeting, each individual who continues to serve as a non-employee Board member, whether or not that individual is standing for re-election to the Board at that particular Annual Meeting, will automatically be granted a non-statutory option to purchase a specified number of shares of the Company's common stock, provided such individual has served as a non-employee Board member for at least six (6) months. The number of shares of common stock subject to each such annual automatic option grant will be determinedpurchased by dividing $20,000 by the Black-Scholes formula value of the option, as determined by the Company's independent financial advisors. However, in no event may such option grant exceed 10,000 shares of common stock. There will be no limit on the number of such annual option grants that any one non-employee Board member may receive over his or her period of Board service.

Each initial 5,000-share or annual $20,000-value option granted under the Automatic Option Grant Program will have an exercise price per share equal to one hundred percent (100%) of the fair market value per share of common stock on the option grant date and a maximum term of ten (10) years measured from the grant date, subject to earlier termination at the end of the twelve (12)-month period measured from the date of the optionee's cessation of Board service. Each initial 5,000-share or annual $20,000-value option is immediately exercisable for all the option shares. However, any shares purchased under the option will be subject to repurchase by the Company, at the option exercise price paid per share, upon the optionee's cessation of Board service prior to vesting in those shares. The shares subject to each initial 5,000-share automatic option grant vest in a series of four (4) successive equal annual installments upon the optionee's completion of each year of Board service over the four

10

(4)-year period measured from the grant date. The shares subject to each annual $20,000-value grant vest upon the optionee's completion of one (1) year of Board service measured from the grant date. Should the optionee cease to serve as a Board member, the optionee will generally have until the earlier of (i) the twelve (12) month period following such cessation of service or (ii) the expiration date of the option term in which to exercise the option forparticipants exceeds the number of shares that are vested atavailable for purchase during the time of such individual's cessation of Board service.

The shares subject to each automatic option grantPurchase Interval, the Company will immediately vest in full upon (i) the optionee's death or permanent disability whilemake a Board member, (ii) an acquisitionpro rata allocation of the Company by merger or asset sale, (iii)shares remaining available for purchase.

Withdrawal/Termination of Participation

Shares will be purchased automatically on the successful completion of a tender offer for more than fifty percent (50%)last day of the Company's outstanding voting stock or (iv)Purchase Interval for a change in the majorityparticipating employee who remains an eligible participant. Participation ends automatically upon an employee's termination of the Board effected through one or more proxy contests for Board membership. In addition, upon the successful completion of a hostile tender offer for more than fifty percent (50%) of the Company's outstanding voting stock, each automatic option grant may be surrendered toemployment with the Company for any reason, including retirement or death. During any Purchase Interval, an employee may withdraw from participation in the ESPP at any time prior to five business days before the end of any Purchase Interval, or may during the Offering Period decrease the rate of salary deductions. Upon a cash distribution per surrendered option shareparticipant's termination or withdrawal from the ESPP, all accumulated payroll deductions for the participant made prior to termination, are returned, without interest, and no shares are purchased for that employee's account.

Shares Subject to the ESPP

The maximum number of shares of common stock which may be purchased by employees under the ESPP, if approved, will be 175,000 shares (of which 69,331 have already been issued pursuant to the ESPP), subject to adjustments for stock splits, stock dividends and similar transactions. The shares may be authorized but unissued shares of common stock, issued shares held in or acquired for the Company's treasury, or shares reacquired by the Company upon purchase in the open market.

Amendment and Termination of the ESPP

The ESPP may be amended or terminated by the Board of Directors in any respect, except that no amendment shall be effective without stockholder approval if the amendment would increase the aggregate number of shares of common stock which may be issued under the ESPP, and no termination, modification or amendment of the ESPP may, with respect to the Offering Period in which the termination, modification or amendment occurs, adversely affect the rights of an employee then participating in the ESPP without the employee's consent.

Federal Income Tax Consequences

The following general summary describes the typical U.S. federal income tax consequences of the ESPP based upon provisions of the Code as in effect on the date hereof, current regulations promulgated and proposed thereunder, and existing public and private administrative rulings of the Internal Revenue Service, all of which are subject to change (possibly with retroactive effect). This summary is not intended to be a complete analysis and discussion of the federal income tax treatment of the ESPP, and does not discuss gift or estate taxes or the income tax laws of any municipality, state, or foreign country.

The ESPP is intended to qualify as an "employee stock purchase plan" under Section 423 of the Code. An employee will not recognize income upon electing to participate in the ESPP or upon purchasing shares under the ESPP. If the employee does not dispose of shares for at lease two years from the beginning of the Offering Period in which the shares were purchased, or in the event of his or her death (whenever occurring), the employee will realize ordinary income upon the disposition (including by sale, gift or death) in an amount equal to the excess of (a)lesser of: (i) the highest price per share of common stock paid in connection with such tender offer over (b) the exercise price payable for such share. Stockholder approval of this Proposal will also constitute pre-approval of each option granted on or after the date of the Annual Meeting with such a surrender right and the subsequent surrender of that option in accordance with foregoing provisions.

Stock Issuance Program

Shares may be sold under the Stock Issuance Program at a price per share not less than the fair market value on the issuance date, payable in cash or through a promissory note payable to the Company. Shares may also be issued solely as a bonus for past services.

The issued shares may either be immediately vested upon issuance or subject to a vesting schedule tied to the performance of service or the attainment of performance goals. The Plan Administrator, however, has the discretionary authority at any time to accelerate the vesting of any and all unvested shares outstanding under the 1996 Plan.

Director Fee Option Grant Program

Under the Director Fee Option Grant Program each non-employee Board member will have the opportunity to elect to apply all or a portion of any annual retainer fee and attendance fees otherwise payable in cash to the acquisition of a below-market option grant. Such election must be made prior to the start of the calendar year to which the election applies. The option grant will automatically be made at the end of each fiscal quarter in the year for which the retainer fee and attendance fees would otherwise be payable in cash. The option will have an exercise price per share equal to one-thirdexcess of the fair market value of the option shares onat the grant date, andtime of disposition over their Purchase Price; or (ii) the number of shares subject to the option will be determined by dividing the applicable quarterly amount of the retainer fee plus the applicable amount of any attendance fees earned during the quarter applied to the program by two-thirdsexcess of the fair market value per share of common stockthe shares on the grant date. As a result,first day of the total spread onOffering Period over their Purchase Price. Any additional gain will be taxed as long-term capital gain. If the option (the fair market value of the option shares on the grant date less the aggregate exercise price payable for those shares) will be equal to the portion of the retainer fee plus the attendance fees invested in that option. The option will be fully vested at the time of grant.

Limited stock appreciation rightstheir disposition is below the Purchase Price, the employee will automatically be included as part of each grant made under the Director Fee Option Grant Program. Options with such a limited stock appreciation right may be surrendered to the Company upon the successful completion of a hostile tender offer for more than 50% of the Company's outstanding voting stock. In return for the surrendered option, the optioneenot recognize any ordinary income, and any loss will be entitled to a cash distribution from thelong-term capital loss. The Company in an amount per surrendered option share equal

11

to the excesswill not have a deductible expense as a result of (i) the highest price per share of common stock paid in connection with the tender offer over (ii) the exercise price payable for such share.

General Provisions

Acceleration

In the event that the Company is acquired by merger or asset sale, each outstanding option under the Discretionary Option Grant Program which is not to be assumed by the successor corporation will automatically accelerate in full, and all unvested shares under the Discretionary Option Grant and Stock Issuance Programs will immediately vest, except to the extent the Company's repurchase rights with respect to those shares are to be assigned to the successor corporation. Any options assumed in connection with such acquisition may, in the Plan Administrator's discretion, be subject to immediate acceleration, and any unvested shares which do not vest at the time of such acquisition may be subject to full and immediate vesting, in the event the individual's service with the successor entity is subsequently terminated within a twelve (12) months following the acquisition. In connection with a change in control of the Company (whether by successful tender offer for more than fifty percent (50%) of the outstanding voting stock or a change in the majority of the Board by one or more contested elections for Board membership), the Plan Administrator will have the discretionary authority to provide for automatic acceleration of outstanding options under the Discretionary Option Grant Program and the automatic vesting of all unvested shares outstanding under the Discretionary Option Grant and Stock Issuance Programs, with such acceleration or vesting to occur either at the time of such change in control or upon the subsequent termination of the individual's service. Each option outstanding under the Automatic Option Grant, Director Fee Option Grant and Salary Investment Option Grant Programs will automatically accelerate in full upon an acquisition or change in control of the Company.

The acceleration of vesting upon a change in the ownership or control of the Company may be seen as an anti-takeover provision and may have the effect of discouraging a merger proposal, a takeover attempt or other efforts to gain control of the Company.

Financial Assistance

The Plan Administrator may institute a loan program to assist one or more participants in financing the exercise of outstanding options or the purchase of sharesstock under the Discretionary Option Grant and Stock Issuance Programs. The Plan Administrator has complete discretion to determineESPP, unless there is a "disqualifying" disposition, as described in the terms of any such financial assistance. However, any such financing will be full-recourse and interest bearing. In addition,next paragraph.

If shares purchased under the maximum amount of financing provided any individual may not exceedESPP are sold by an employee within two years after the cash consideration payable for the issued shares plus all applicable taxes.

Stock Awards

The table below shows, as to eachbeginning of the Company's executive officers named in the Summary Compensation Table and the various indicated individuals and groups, the number of shares of common stock subject to options granted under the 1996 Plan between January 1, 2002 and March 31, 2003, together with the weighted average exercise price payable per share.

12

| | Options Granted (Number of Shares) | Weighted Average Exercise Price | |||

|---|---|---|---|---|---|

| Charles F. Willis, IV | 231,000 | $ | 5.03 | ||

| Donald A. Nunemaker | 126,650 | $ | 4.81 | ||

| Monica J. Burke | 35,000 | $ | 4.88 | ||

| Thomas E. MacAleavey | 25,000 | $ | 5.01 | ||

| Nicholas J. Novasic | — | — | |||

| All current executive officers as a group (4 persons) | 417,650 | $ | 4.95 | ||

| All current non-employee directors as a group (3 persons) | 44,246 | $ | 3.74 | ||

| All current employees, including current officers who are not executive officers, as a group (38 persons) | 186,274 | $ | 4.94 | ||

As of March 31, 2003, options covering 1,872,426 shares of common stock were outstanding under the 1996 Plan, 348,601 shares remained available for future option grants, and 303,973 shares have been issued under the 1996 Plan in connection with option exercises.

Amendment and Termination. The Board may amend or modify the 1996 Plan in any or all respects whatsoever, subject to any stockholder approval required under applicable law or regulation. The Board may terminate the 1996 Plan at any time, and the 1996 Plan will in all events terminate on June 19, 2006.

Federal Income Tax Consequences

Option Grants granted under the 1996 Plan may be either incentive stock options which satisfy the requirements of Section 422 of the Internal Revenue Code or non-statutory options which are not intended to meet such requirements. The Federal income tax treatment for the two types of options differs as follows:

Incentive Options. No taxable income is recognized by the optionee at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised. The optionee will, however, recognize taxable income in the yearOffering Period in which the shares were purchased, shares are sold or otherwise madethen that sale constitutes a "disqualifying" disposition in which the subject of a taxable disposition. For Federal tax purposes, dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. A qualifying disposition occurs if the sale or other disposition is made after the optionee has held the shares for more than two (2) years after the option grant date and more than oneemployee will realize (1) year after the exercise date. If either of these two (2) holding periods is not satisfied, then a disqualifying disposition will result.

Upon a qualifying disposition, the optionee will recognize long-term capital gainordinary income in an amount equal to the excess of (i) the amount realized upon the sale or other disposition of the purchased shares over (ii) the exercise price paid for the shares. If there is a disqualifying disposition of the shares, then the lesser of (i) the difference between the fair market value of those shares on the exercise date over purchase price paid per shares or (ii) the amount realized over the purchase price paid will be taxable as ordinary income to the optionee.

If the optionee makes a disqualifying disposition of the purchased shares, then the Company will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal to the lesser of (i) the difference between the fair market value of those shares on the exercise date over purchase price paid per shares or (ii) the amount realized over the purchase price paid. In no other

13

instance will the Company be allowed a deduction with respect to the optionee's disposition of the purchased shares.

Non-Statutory Options. No taxable income is recognized by an optionee upon the grant of a non-statutory option. The optionee will in general recognize ordinary income, in the year in which the option is exercised, equal to the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares, and the optionee will be required to satisfy the tax withholding requirements applicable to such income.

If the shares acquired upon exercise of the non-statutory option are unvested and subject to repurchase by the Company in the event of the optionee's termination of service prior to vesting in those shares, then the optionee will not recognize any taxable income at the time of exercise but will have to report as ordinary income, as and when the Company's repurchase right lapses, an amount equal to the excess of (i) the fair market value of the shares on the date of purchase (i.e.,the repurchase right lapses over (ii) the exercise price paid for the shares. The optionee may, however, elect under Section 83(b)last day of the Internal Revenue Code to include as ordinary income inOffering Period) over the year of exercise of the option an amountPurchase Price, and (2) a capital gain or loss equal to the excess ofdifference between: (i) the fair market valueamount received for the shares; and (ii) the sum of the purchased shares onPurchase Price and the exercise date over (ii) the exercise price paid for such shares.amount of ordinary income recognized. If the Section 83(b) election is made,disqualifying disposition occurs more than one year after the optioneedate of purchase, any capital gain or loss will not recognize any additionalbe long-term; otherwise it will be short-term. If an employee recognizes ordinary income as and whena result of a disqualifying disposition, the repurchase right lapses.

The Company will be entitled to ana corresponding deduction. To the extent required under the Code and Internal Revenue Service guidance, the Company will withhold income tax deduction equal to the amount of ordinary income recognized by the optioneeand employment taxes with respect to the exercised non-statutory option. The deduction will in general be allowed for the taxable yearpurchases and dispositions of the Company in which such ordinary income is recognized by the optionee.

Stock Appreciation Rights. An optionee who is granted a stock appreciation right will recognize ordinary income in the year of exercise equal to the amount of the appreciation distribution. The Company will be entitled to an income tax deduction equal to such distribution for the taxable year in which the ordinary income is recognized by the optionee.

Direct Stock Issuance. The tax principles applicable to direct stock issuancesshares under the 1996 Plan will be substantially the same as those summarized above for the exercise of non-statutory option grants.

Deductibility of Executive Compensation. The Company anticipates that any compensation deemed paid by it in connection with disqualifying dispositions of incentive stock option shares or exercises of non-statutory options will qualify as performance-based compensation for purposes of Internal Revenue Code Section 162(m) and will not have to be taken into account for purposes of the $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company. Accordingly, all compensation deemed paid with respect to those options will remain deductible by the Company without limitation under Internal Revenue Code Section 162(m).

Accounting Treatment

Option grants or stock issuances with exercise or issue prices less than the fair market value of the shares on the grant or issue date will result in a direct compensation expense to the Company's earnings equal to the difference between the exercise or issue price and the fair market value of the shares on the grant or issue date. Such expense will be accruable by the Company over the period that the option shares or issued shares are to vest. Option grants or stock issuances with exercise or issue prices equal to the fair market value of the shares at the time of issuance or grant will not result in any charge to the Company's earnings, but the Company must disclose in the notes to the Company's financial statements the fair value of options granted under the 1996 Plan and the pro forma impact on the Company's annual net income and earnings per share as though the computed fair value of such

14

options had been treated as compensation expense. In addition, the number of outstanding options may be a factor in determining the Company's earnings per share on a fully-diluted basis. Should one or more optionees be granted stock appreciation rights which have no conditions upon exercisability other than a service or employment requirement, then such rights will result in a compensation expense to the Company's earnings.

In March 2000, the Financial Accounting Standards Board issued interpretation number 44, "Accounting for Certain Transactions Involving Stock Compensation, an Interpretation of APB Opinion 25." Under this interpretation, option grants made to independent consultants (but not non-employee Board members) will result in a direct charge to the Company's reported earnings based upon the fair value of the option measured initially as of the grant date of that option and then subsequently on the vesting date of each installment of the underlying option shares. Such charge will accordingly include the appreciation in the value of the option shares over the period between the grant date of the option and the vesting date of each installment of the option shares. In addition, after the implementation date, any options which are repriced will also trigger a direct charge to the Company's reported earnings measured by the appreciation in value of the underlying shares between the grant date of the option and the date the option is exercised for those shares.

New Plan Benefits

As of March 31, 2003, no options have been granted, and no direct stock issuances have been made on the basis of the 500,000 share increase of common stock to be authorized for issuance under this Proposal.

Stockholder ApprovalESPP.

The affirmative vote of a majority of the outstanding voting shares of the Company presentvoted in person or represented and entitled to voteby proxy at the 20032004 Annual Meeting of Stockholders is required for approvaladoption of the amendment to the 1996 Plan. Should such stockholder approval not be obtained, then any options granted on the basis of the 500,000 share increase of common stock to be authorized for issuance under this Proposal will terminate without becoming exercisable and no further options will be granted on the basis of such share increase. The 1996 Plan will continue to remain in effect, and option grants and direct stock issuances may continue to be made pursuant to the provisions of the 1996 Plan in effect prior to the new amendment, until the available reserve of common stock as last approved by the stockholders has been issued pursuant to option grants made under the 1996 Plan.No. 2.

THE COMPANY'S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE PROPOSED AMENDMENT TOAND RESTATEMENT OF THE 1996 PLAN.ESPP.

Equity Compensation Plan Information

The following table outlines the Company's Equity Compensation Plan Information as of December 31, 2002.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||

|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 1,537,412 | $ | 7.13 | 683,615 | ||||

Equity compensation plans not approved by security holders | n/a | n/a | n/a | |||||

Total | 1,537,412 | $ | 7.13 | 683,615 | ||||

15

EXECUTIVE OFFICERS OF WILLIS LEASE FINANCE CORPORATION

The executive officers of Willis Lease Finance are as follows:

| Name | Age* | Positions and Offices | ||

|---|---|---|---|---|

| Charles F. Willis, IV** | 54 | Chief Executive Officer and President | ||

| Donald A. Nunemaker | 55 | Executive Vice President and Chief Operating Officer | ||

| Monica J. Burke | 51 | Executive Vice President and Chief Financial Officer | ||

| Thomas E. MacAleavey | 50 | Senior Vice President, Sales and Marketing | ||

| Thomas C. Nord | 63 | Senior Vice President, General Counsel and Secretary |

Donald A. Nunemaker has been with Willis Lease Finance since July 1997 and currently serves as Willis Lease Finance's Executive Vice President and Chief Operating Officer. Prior to his appointment as COO, he served as Chief Administrative Officer until March 2001. Mr. Nunemaker also served on the Willis Lease Finance Board of Directors from June to November 2000. Mr. Nunemaker is responsible for managing the day-to-day operation of Willis Lease Finance and has been extensively involved in the equipment leasing industry since 1973. From 1995 to 1996, Mr. Nunemaker was President and CEO of LeasePartners, Inc., a leasing company based in Burlingame, California, which was acquired in 1996 by Newcourt Credit Group. From 1990 to 1994, Mr. Nunemaker was Executive Vice President of Concord Asset Management, Inc., an aircraft and computer leasing subsidiary of Concord Leasing, Inc., which was owned by the HSBC Group. Before joining Concord in 1990, Mr. Nunemaker was President and CEO of Banc One Leasing Corporation of New Jersey. Prior to that he spent thirteen years with Chase Manhattan Leasing Company in a variety of senior line and staff positions. Mr. Nunemaker has an M.B.A. degree from Indiana University.

Monica J. Burke has served as the Company's Executive Vice President and Chief Financial Officer since July 2002. Ms. Burke is responsible for the capital markets, finance, treasury, accounting, risk management, tax compliance, and systems functions of the Company. She was previously the CFO of two publicly-traded companies for a total of thirteen years, and from 1999 until 2002 she was the COO of Rosewood Stone Group, a private venture capital firm in Mill Valley, California. From 1988 to 1999, Ms. Burke was CFO of Valley Forge Corporation, a publicly traded conglomerate headquartered in San Rafael, California that manufactured products for the electronics, industrial and marine industries. From 1984 to 1986, Ms. Burke was the CFO for Western Micro Technology Corporation, a publicly-traded distributor of electronic components and systems located in Cupertino, California. Ms. Burke was with Price Waterhouse and Coopers and Lybrand from 1976 to 1984, initially as an auditor and ending as a tax manager. She graduated with honors in Business Administration from the University of Oregon.

Thomas E. MacAleavey joined Willis Lease Finance Corporation in 1998 as Vice President of Marketing. Effective as of February 20, 2002, Mr. MacAleavey was designated Senior Vice President, Sales and Marketing. From 1996 to 1998, Mr. MacAleavey was Managing Director of MacAleavey Aviation Inc., advising airlines and financial institutions on the acquisition and sale of aviation related portfolios. From 1990 to 1996, he was Vice President, Aircraft Marketing at Concord Asset Management, Inc., an aircraft and computer leasing subsidiary of Concord Leasing, Inc., which was owned by the HSBC Group. Prior to 1990, he held director of marketing positions at Guinness Peat Aviation, GATX Leasing, and Intercredit Corporation. From 1975 to 1977, Mr. MacAleavey was with the Ministry of Commerce in Ireland as part of the Foreign Trade Delegation working in South

America and Eastern Europe. He started his career at The Economist Intelligence Unit in London. He is a graduate in Economics of Trinity College, Dublin.

16 Thomas C. Nord has served as the Company's Senior Vice President and General Counsel since July 2003. Mr. Nord is responsible for managing the Company's legal affairs. From May 1977 to March 2003, he was an attorney with GATX Financial Corporation, San Francisco, California, a specialized finance and leasing company ("GATX"). During most of his career at GATX, from January 1981 until March 2003, he was Managing Director, General Counsel and Secretary of GATX. From February 1974 until May 1997, Mr. Nord was Counsel to Irving Trust Company, New York, New York. From June 1969 to February 1974 Mr. Nord was associated with the New York City law firm of Seward & Kissel. Mr. Nord holds a JD degree from the University of North Carolina.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of Willis Lease Finance's common stock as of March 31, 2003 by2004 by: (i) each person who is known to Willis Lease Finance to own beneficially more than five percent of the outstanding shares of Willis Lease Finance's common stock; (ii) each Director; (iii) each officer listed in the Summary Compensation Table; and (iv) all Directors and Executive Officers as a group. Unless specified below, the mailing address for each individual, officer or director is c/o Willis Lease Finance Corporation, 2320 Marinship Way, Suite 300, Sausalito, CA 94965.

| | Common stock(1) | Common stock(1) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name and Address of Beneficial Owner | Number of Shares | Percentage of Class | Number of Shares | Percentage of Class | ||||||

| Charles F. Willis, IV | 3,365,807 | (2) | 36.88 | % | 3,460,085 | (2) | 37.33 | % | ||

| Donald A. Nunemaker | 244,234 | (3) | 2.69 | % | 314,397 | (3) | 3.42 | % | ||

| Thomas E. MacAleavey | 30,500 | (4) | * | 52,500 | (4) | * | ||||

| Monica Burke | — | * | 9,250 | * | ||||||

| Nicholas J. Novasic(5) | 6,965 | * | ||||||||

| Thomas C. Nord | — | * | ||||||||

| W. William Coon Jr.(6) | — | * | ||||||||

| Hans Jörg Hunziker(6) | — | * | — | * | ||||||

| William M. LeRoy | 46,953 | (7) | * | 63,071 | (7) | * | ||||

| Willard H. Smith, Jr. | 17,475 | (8) | * | |||||||

| Gérard Laviec | 12,202 | (9) | * | 25,369 | (8) | * | ||||

| Glenn L. Hickerson | 23,987 | (10) | * | 43,451 | (9) | * | ||||